Terreno Realty (TRNO)·Q4 2025 Earnings Summary

Terreno Realty Beats on Revenue and FFO as Lease Termination Fees Boost Q4

February 5, 2026 · by Fintool AI Agent

Terreno Realty Corporation (NYSE: TRNO) delivered a strong Q4 2025, beating analyst expectations on both revenue and FFO per share. Revenue came in at $137.5M, 7.8% above the $127.6M consensus estimate, while FFO per share of $0.83 exceeded the $0.77 consensus by 7.3%. The industrial REIT focused on coastal U.S. markets saw its shares rise 3.0% on the day of the earnings release.

The outperformance was driven by $18.4M in lease termination income, strong same store NOI growth, and continued acquisition activity. Management highlighted the company's disciplined infill strategy, with 42% of the portfolio in shrinking supply submarkets that offer structural tailwinds.

Did Terreno Realty Beat Earnings?

Yes — both revenue and FFO beat consensus estimates.

The strong beat was significantly boosted by $18.4M in lease termination income during the quarter. This included $13.8M in termination fees from leases that ended, plus $5.8M from below-market lease write-offs, partially offset by a $1.3M fee paid for a lease buyout.

Excluding termination fees, cash same store NOI grew 4.0% in Q4 and 6.4% for full year 2025 — still solid but highlighting the one-time nature of the Q4 upside.

How Did the Stock React?

Shares of TRNO closed at $64.44 on February 4, 2026, up $1.90 (+3.0%) on the day of the earnings release. The stock is now trading:

- +5.4% above its 50-day moving average ($61.13)

- +10.2% above its 200-day moving average ($58.49)

- -6.9% below its 52-week high of $69.20

The positive reaction reflects investor appreciation for the beat, though some may view the termination fee income as non-recurring. Year-to-date, TRNO has outperformed following a challenging 2024 where the stock fell from $65 highs to $48 lows.

What Changed From Last Quarter?

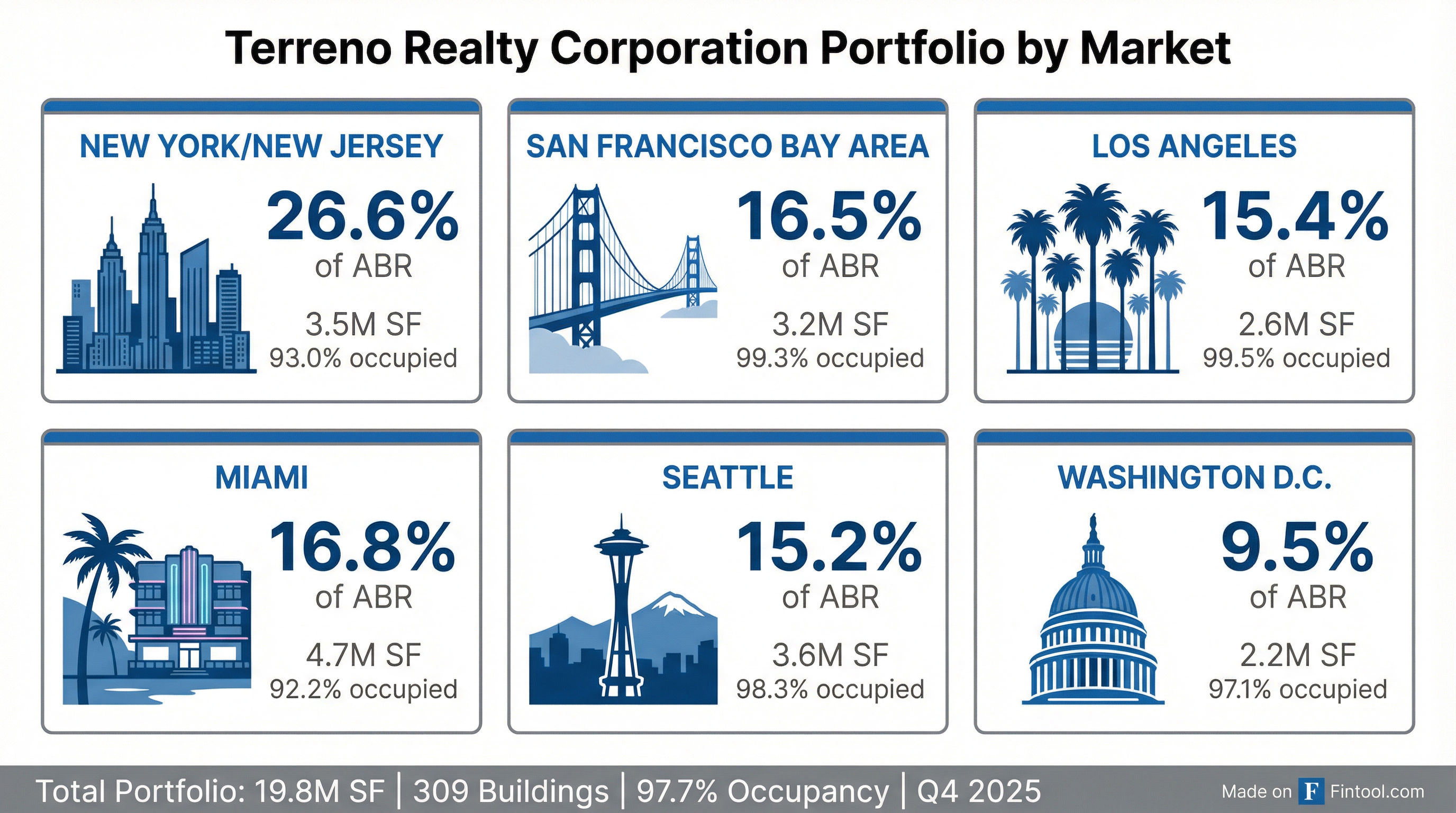

The sequential improvement was notable across all key metrics. The 160 bps jump in portfolio occupancy to 97.7% demonstrates strong leasing momentum, while the 29.8% cash rent increase on renewals shows pricing power in the company's infill markets.

Full Year 2025 Highlights

For the full year 2025, Terreno delivered exceptional results:

The 11.8% dividend CAGR since 2011 and 10.0% total shareholder return CAGR since the 2010 IPO demonstrate Terreno's track record of value creation.

What Is Terreno's Investment Strategy?

Terreno pursues a focused coastal infill strategy that differentiates it from other industrial REITs:

- Six coastal markets only: NYC/New Jersey, Los Angeles, San Francisco Bay Area, Miami, Seattle, and Washington D.C.

- 42% in shrinking supply submarkets: Areas where industrial supply is declining due to urbanization and rezoning

- 41% in no net new supply submarkets: Older infill areas with redevelopment opportunities

- Highest population density: 15,750 people per square mile within 5 miles of portfolio vs. 5,200 for peer average

This strategy provides structural tailwinds as these constrained submarkets experience continued rent growth and higher-and-better-use conversion opportunities.

Capital Markets and Balance Sheet

Terreno maintains a conservative balance sheet with investment-grade credit:

Recent capital markets activity:

- Issued 700K shares at $62.27 avg price in Q4 2025 for $43.6M gross proceeds

- Full year 2025: 4.2M shares issued for $281M gross proceeds

- New $200M 5-year term loan issued January 2026 at SOFR + 1.15%

- Revolver balance reduced from $200M at year-end to $50M as of February 3, 2026

The leverage improvement to 2.3x Net Debt/EBITDA reflects the strong NOI growth and disposition activity during the year.

Development Pipeline

Terreno has approximately 1.2M square feet under development or redevelopment with attractive stabilized cap rates:

The 139th Street redevelopment is a major project that is 48.9% pre-leased and represents significant NAV upside upon completion.

Dividend Declared

Terreno declared a quarterly dividend of $0.52 per share for Q1 2026, payable April 10, 2026 to shareholders of record March 27, 2026.

At the current share price of $64.44, this represents an annualized yield of approximately 3.2%. The dividend has grown at an 11.8% CAGR since initiation in 2011.

Key Risks Flagged

Management highlighted several risk factors in their filings:

- Trade policy uncertainty: A decline in economic activity from tariffs and trade policy changes could impact demand

- Interest rate sensitivity: 42.4% floating rate debt exposure creates interest expense variability

- Tenant concentration: Lease terminations, while generating short-term income, require re-leasing

- Development risk: 1.2M SF under development with pre-leasing ranging from 0% to 100%

The high exposure to import/export-driven coastal markets creates sensitivity to trade flows, with 49% of LA/Long Beach imports from China and 20% of NYC/Newark imports from China.

Forward Catalysts

Looking ahead, investors should watch for:

- Development deliveries: Countyline Phase IV (Q1 2026) and Building 32 (Q2 2026) stabilizations

- Leasing progress: 139th Street redevelopment pre-leasing beyond current 48.9%

- Acquisition activity: $113.2M under contract as of earnings date

- Cash rent growth sustainability: Can the 25%+ spreads continue?

- ESG milestones: 1.0M SF LEED certification target for 2026

Bottom Line

Terreno Realty delivered a strong Q4 with beats on both revenue (+7.8%) and FFO (+7.3%), though lease termination income of $18.4M was a significant contributor. The underlying business remains healthy with 97.7% occupancy, 29.8% cash rent spreads, and improving leverage metrics. The focused coastal infill strategy continues to generate attractive returns, with an 11.1% average cash same store NOI growth rate since IPO demonstrating the durability of the approach.

For more details, see the full Q4 2025 10-K filing and earnings presentation.

Data sourced from company filings and S&P Global.